UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

Schedule 14A

________________________________

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant |

☒ |

|

|

Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

|

☒ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

Relmada Therapeutics, Inc.

_____________________________________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply): |

||

|

☒ |

No fee required |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

April [•], 2022

Dear Stockholders,

On behalf of all of us at Relmada Therapeutics, we are very pleased to share with you the significant progress we achieved in 2021 and outline our key priorities and expected milestones for 2022. As a reminder, our mission at Relmada is to target major advances in the treatment of Central Nervous System (CNS) disorders. Our lead compound, REL-1017 (esmethadone, dextromethadone), has shown potential benefit in large and underserved medical conditions. Our most advanced clinical development programs are currently evaluating the use of REL-1017 as a potential treatment of major depressive disorder (MDD), in the adjunctive and monotherapy settings.

2021 was a year of building and significant operational and regulatory accomplishments for Relmada.

Below is a more detailed summary of our successes in 2021, as well as very recent achievements. Following this, we are also excited to provide an outline of the significant opportunities that lie ahead for Relmada in 2022.

Key Highlights

• On April 1, 2021, Relmada announced the initiation of RELIANCE II, the second of two sister pivotal Phase 3 clinical trials (RELIANCE I and RELIANCE II) of REL-1017, as an adjunctive treatment for MDD. Patients who complete RELIANCE I and RELIANCE II are eligible to rollover into the long-term, open-label study, which also includes subjects who had not previously participated in a REL-1017 clinical trial.

• On October 4, 2021, Relmada announced the initiation RELIANCE III, the ongoing monotherapy trial for REL-1017, which aims to randomize 364 patients and is expected to be completed in mid-2022.

• On July 27, 2021, we announced top-line results that showed that all three doses of REL-1017 (25 mg, 75 mg and 150 mg, the therapeutic, supratherapeutic and maximum tolerated doses, respectively) tested in recreational opioid users, demonstrated a highly statistically significant difference vs. the active control drug, oxycodone 40 mg. The study’s primary endpoint was a measure of “likability” with the subjects rating the maximum effect (or Emax) for Drug Liking “at the moment”, using a 1=100 bipolar rating scale (known as a visual analog scale or VAS), with 100 as the highest likability, 50 as neutral (placebo-like), and 0 the highest dislike. In summary, all tested doses of REL-1017, including the maximum tolerated dose, showed a highly statistically significant difference in abuse potential versus oxycodone with p-values less than 0.001.

• On February 23, 2022, we announced top-line results that showed that all three doses of REL-1017 (25 mg, 75 mg, and 150 mg, the therapeutic, supratherapeutic and maximum tolerated doses, respectively) tested in recreational drug users, demonstrated a substantial (30+ points) and statistically significant difference vs. the active control drug, intravenous ketamine 0.5 mg/kg over 40 minutes, and were statistically equivalent to placebo. The study’s primary endpoint was a measure of “likability” with the subjects rating the maximum effect (or Emax) for Drug Liking “at this moment”, using a 1-100 bipolar rating scale (known as a visual analog scale or VAS), with 100 as the highest likability, 50 as neutral (placebo-like), and 0 the highest dislike. Consistent results are seen for the secondary endpoints.

Expected Key Strategic Priorities and Milestones:

We expect multiple key milestones over the next 12-18 months. These include:

• Results of RELIANCE III monotherapy MDD trial in mid-2022.

• Results of RELIANCE I and RELIANCE II adjunctive MDD trials in the third-quarter and fourth-quarter of 2022, respectively.

• Results of RELIANCE – OLS (Long-term, Open-label) study in MDD in the fourth-quarter of 2022.

We are deeply grateful for the daily efforts and commitments of patients, clinical trial volunteers, clinical partners, our employees, strategic partners, and Board of Directors, as well as the support of our shareholders. 2022 is an exciting year for Relmada as we continue to focus on advancing REL-1017 as a rapid-acting oral treatment for depression and potentially other CNS disorders. We recognize the high unmet need that exists in depression for a new safe and effective therapy and truly believe that REL-1017 can successfully address this devastating disease. We look forward to providing you with updates on our progress throughout the year. Thank you, again, for your interest in and support of Relmada.

Sincerely,

/s/ Sergio Traversa

Sergio Traversa

Chief Executive Officer

Relmada Therapeutics, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [*], 2022

To the stockholders of Relmada Therapeutics, Inc.,

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Relmada Therapeutics, Inc. to be held in a virtual-only meeting format via live webcast on the Internet on [*], 2022 at [*] a.m. Eastern Time. At the annual meeting you will be asked to vote on the following matters:

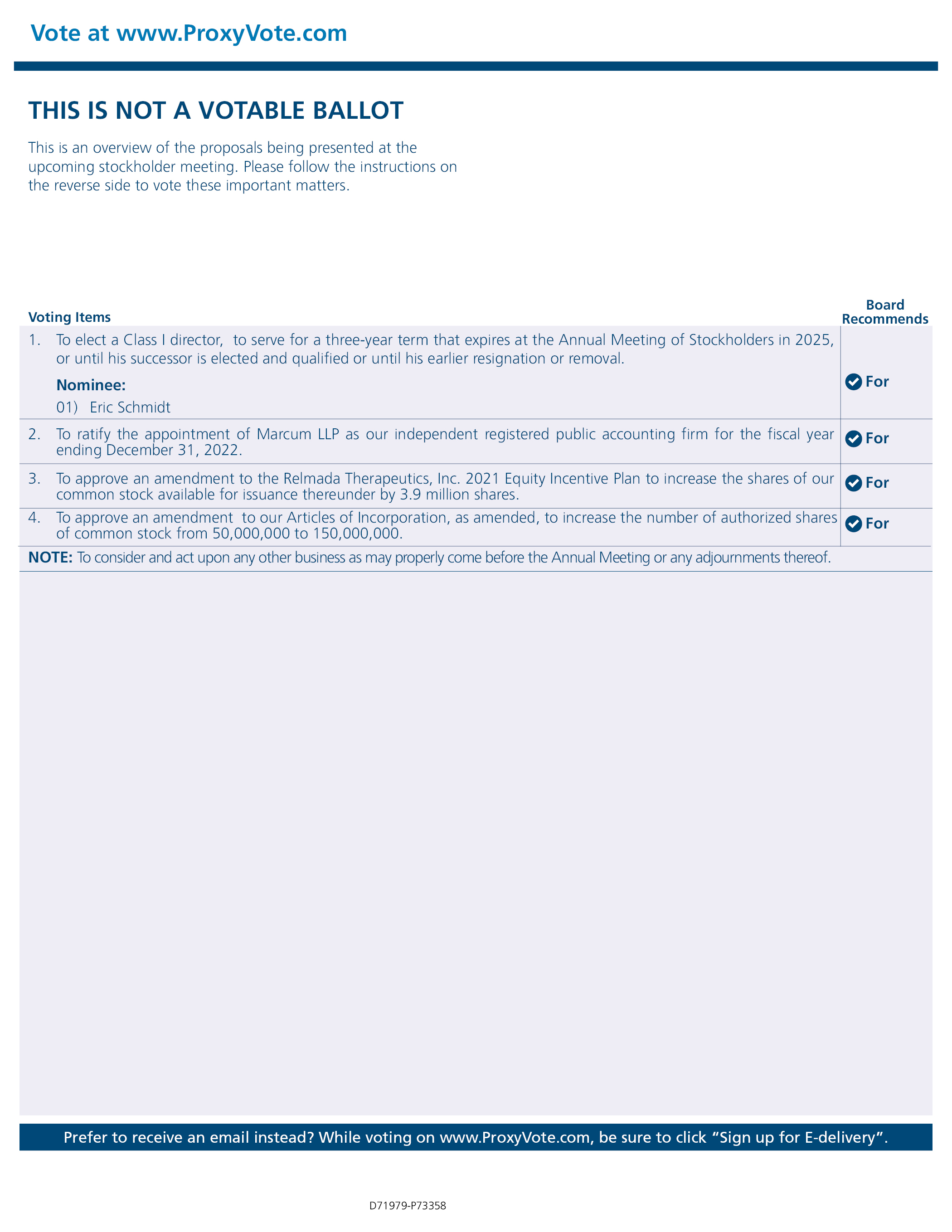

• Proposal 1: To elect Eric Schmidt, as a Class I director, to serve for a three-year term that expires at the Annual Meeting of Stockholders in 2025, or until his successor is elected and qualified or until his earlier resignation or removal;

• Proposal 2: To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

• Proposal 3: To approve an amendment to the Relmada Therapeutics, Inc. 2021 Equity Incentive Plan to increase the shares of our common stock available for issuance thereunder by 3.9 million shares; and

• Proposal 4: To approve an amendment to our Articles of Incorporation, as amended, to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000.

We also will transact such other business as may properly come before the annual meeting or any adjournments thereof.

The Board of Directors recommends that you vote at the annual meeting “FOR” the election of each nominee as director and “FOR” each of the other proposals set forth in this Notice These items of business are more fully described in the proxy statement that is attached to this Notice. The Board of Directors has fixed the close of business on [*], 2022 as the “Record Date” for determining the stockholders that are entitled to notice of and to vote at the annual meeting and any adjournments thereof. A list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose related to the meeting to the Annual Meeting, by appointment, for a period of ten days before the meeting in person at our corporate offices in Coral Gables, Florida, and in electronic form at the meeting.

It is important that your shares are represented and voted at the meeting. You can vote your shares by completing, signing, and returning your completed proxy card or vote by mail, internet or by fax by following the instructions included in the proxy statement. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement.

We are holding the 2022 Annual Meeting of Stockholders in a virtual-only meeting format via live webcast on the Internet. You will not be able to attend at a physical location. Stockholders will be able to join and attend online by logging in at www.virtualshareholdermeeting.com/RLMD2022. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

|

By Order of the Board of Directors |

||

|

/s/ Charles J. Casamento |

||

|

Coral Gables, FL |

Chairman of the Board |

|

|

[*], 2022 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

The Proxy Statement and the 2021 Annual Report on Form 10-K are available at

www.relmada.com or www.proxyvote.com

|

Page |

||

|

1 |

||

|

1 |

||

|

6 |

||

|

6 |

||

|

9 |

||

|

11 |

||

|

12 |

||

|

13 |

||

|

16 |

||

|

16 |

||

|

21 |

||

|

22 |

||

|

22 |

||

|

24 |

||

|

25 |

||

|

26 |

||

|

Potential Payments Under Severance/Change in Control Arrangements |

26 |

|

|

28 |

||

|

30 |

||

|

31 |

||

|

32 |

||

|

33 |

||

|

Proposal 3 — To approve an amendment to the Relmada Therapeutics, Inc. 2021 Equity Incentive Plan |

34 |

|

|

46 |

||

|

46 |

||

|

46 |

||

|

46 |

||

|

46 |

||

|

47 |

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Returning Their Proxies

i

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

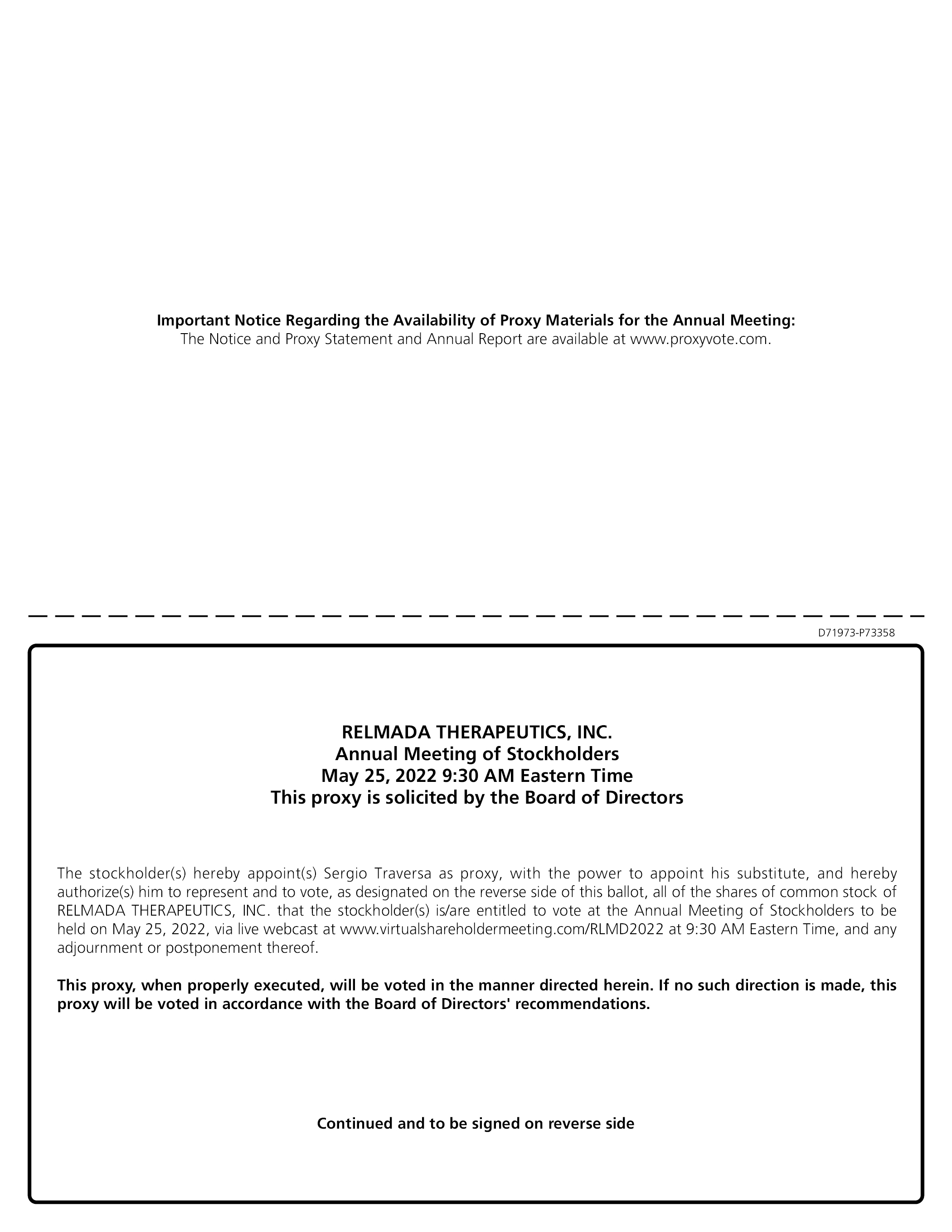

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Relmada Therapeutics, Inc. for use at our 2022 annual meeting of stockholders to be held in a virtual-only (online) meeting format via live webcast on the Internet on [*], 2022 at [*] a.m. Eastern Time. Voting materials, including this proxy statement and proxy card, are expected to be first delivered to all or our stockholders on or about [*], 2022.

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What may I vote on at the annual meeting?

At the annual meeting, stockholders will consider and vote upon the following matters:

• to elect Eric Schmidt, as a Class I director, to serve for a three-year term that expires at the Annual Meeting of Stockholders in 2025, or until his successor is elected and qualified or until his earlier resignation or removal;

• to ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

• to approve an amendment to the Relmada Therapeutics, Inc. 2021 Equity Incentive Plan to increase the shares of our common stock available for issuance thereunder by 3.9 million shares; and

• to approve an amendment to our Articles of Incorporation, as amended, to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000; and

• such other matters as may properly come before the annual meeting or any adjournments or postponement thereof.

How does the Board of Directors recommend that I vote on the proposals?

Our Board unanimously recommends that the stockholders vote “FOR” the election of each nominee as director and “FOR” each of the other proposals being put before our stockholders at the meeting.

How do I vote?

Whether you plan to attend the online annual meeting or not, our Board urges you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares in the manner you indicate. You may specify whether your shares: should be voted for or withheld for the nominees for director; should be voted for, against or abstained with respect to the ratification of the appointment of the Company’s independent registered public accounting firm; and should be voted for, against or abstained with respect to approving the amendment to our stock plan. Voting by proxy will not affect your right to virtually attend the annual meeting. If your shares are registered directly in your name through our transfer agent, Empire Stock Transfer, or you have stock certificates registered in your name, you may submit a proxy to vote:

• By Internet or by telephone. Follow the instructions attached to the proxy card to submit a proxy to vote by Internet or telephone.

• By mail. If you received one or more proxy cards by mail, you can vote by mail by completing, signing, and returning the enclosed proxy card applicable to your class of stock in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board.

1

• On the day of the meeting, you may go to www.virtualshareholdermeeting.com/RLMD2022, and log in by entering the 16-digit control number found on your proxy card, voting instruction form, or Notice, as applicable. If you do not have your control number, you will be able register as a guest; however, you will not be able to vote or submit questions during the meeting.

Telephone and Internet voting facilities for all stockholders of record will be available 24-hours a day and will close at 11:59 p.m., Eastern Time, on [*], 2022.

If your shares are held in “street name” (held in the name of a bank, broker or other nominee who is the holder of record), you must provide the bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

• By Internet or by telephone. Follow the instructions you receive from the record holder to vote by Internet or telephone.

• By mail. You should receive instructions from the record holder explaining how to vote your shares.

How may I attend and participate in the Meeting?

We will be hosting the meeting live via the internet. There will not be a physical location for the meeting. Our virtual meeting allows stockholders to submit questions and comments before and during the meeting. After the meeting, we will spend up to 15 minutes answering stockholder questions. Our virtual format also allows stockholders from around the world to participate and ask questions and for us to give thoughtful responses. Any stockholder can listen to and participate in the meeting live via the internet at www.virtualshareholdermeeting.com/RLMD2022. Stockholders may begin submitting written questions through the internet portal at [*] a.m. (Eastern Time) on [*], 2022, and the webcast of the annual meeting will begin at [*] a.m. (Eastern Time) that day.

Stockholders may also vote while connected to the meeting on the Internet. You will need the control number included on your Notice or your proxy card (if you received a printed copy of the proxy materials) in order to be able to vote your shares or submit questions. Instructions on how to connect and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/RLMD2022.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual shareholder meeting log in page.

If you do not have your control number, you will be able to listen to the meeting only — you will not be able to vote or submit questions.

What happens if additional matters are presented at the annual meeting?

Other than the matters identified in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Sergio Traversa, PharmD, MBA, our Chief Executive Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters and as the proxy holder may determine in her or his discretion with respect to any other matters properly presented for a vote before the annual meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 2 — Ratification of the appointment of Marcum LLP as our independent registered public accounting firm is considered a routine matter, and thus your stockbroker, bank or other

2

nominee may exercise their discretionary voting power with respect to this Proposal. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 — the election of Eric Schmidt to our Board of Directors, and Proposal 3 — the amendment to the Relmada Therapeutics, Inc. 2021 Equity Incentive Plan. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On [*], 2022, the Record Date for determining which stockholders are entitled to vote at the annual meeting or any adjournments or postponements thereof, there were [*] shares of our common stock outstanding which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. Holders of thirty-four percent (34%) of our outstanding stock as of the Record Date must be present at the annual meeting (in person or represented by proxy) in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the annual meeting, if you are present and vote online at the meeting or have properly submitted a proxy card or voted by mail, internet or fax.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date or by attending the annual meeting at www.virtualshareholdermeeting.com/RLMD2022 and voting at the meeting. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy be revoked.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our Company or to third parties, except:

• as necessary to meet applicable legal requirements;

• to allow for the tabulation of votes and certification of the vote; and

• to facilitate a successful proxy solicitation.

Any written comments that a stockholder might include on the proxy card may be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our inspector of elections and reported in a Current Report on Form 8-K, which we will file with the Securities and Exchange Commission, or SEC, within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one Relmada Therapeutics, Inc. stock account, we are delivering only one Notice to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another

3

stockholder and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of a single copy of this Notice. For future annual meetings, you may request separate Notices, or request that we send only one Notice to you if you are receiving multiple copies, by writing or calling us at:

Relmada Therapeutics, Inc.

Attention: Sergio Traversa, Chief Executive Officer

2222 Ponce de Leon Blvd., 3rd Floor

Coral Gables, Florida 33134

Tel: (786) 629-1376

Who pays for the cost of this proxy solicitation?

We will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone.

How can I obtain a copy of Relmada Therapeutics, Inc.’s 2021 Annual Report on Form 10-K?

You may obtain a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 by sending a written request to the address listed above under “How can I obtain a separate set of voting materials?” Our 2021 Annual Report on Form 10-K is available by accessing our Investor Relations page at www.relmada.com and our Form 10-K with exhibits is available on the website of the SEC at www.sec.gov.

What is the voting requirement to elect directors?

Directors are elected by a plurality of the votes cast in person or by proxy at the annual meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the meeting. Broker non-votes will not affect the outcome of the election of directors because brokers do not have discretion to cast votes on this proposal without instruction from the beneficial owner of the shares.

What is the voting requirement to approve the other proposals?

The proposal to ratify the appointment of Marcum LLP as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal.

The proposal to approve an amendment to our 2021 Equity Inventive Plan to increase the shares authorized under the plan will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal.

The proposal to approve an amendment to our Articles of Incorporation, as amended, to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000 requires the votes cast “FOR” the proposal equals at least a majority of the outstanding shares of common stock as of the Record Date.

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the annual meeting.

4

How many votes are required to approve other matters that may come before the stockholders at the meeting?

An affirmative vote of a majority of the votes cast at the meeting is required for approval of all other items being submitted to the stockholders for their consideration.

How can I communicate with the non-employee directors on the Relmada Therapeutics, Inc. Board of Directors?

The Board of Directors encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our Chairman of the Board. Stockholders can send communications by mail to:

Charles J. Casamento, Chairman of the Board

Relmada Therapeutics, Inc.

2222 Ponce de Leon Blvd., Floor 3

Coral Gables, Florida 33134

Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our Chairman of the Board, deals with the functions of the Board of Directors or committees thereof or that our Chairman of the Board otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of the Board of Directors and request copies of any such correspondence.

5

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by calling Sergio Traversa, our Chief Executive Officer at (786) 629-1376.

Board of Directors

The Board of Directors oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, the Board of Directors does not involve itself in day-to-day operations of the Company. The directors keep themselves informed through discussions with the Chief Executive Officer, other key executives and by reading the reports and other materials that we send them and by participating in Board of Directors and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director. Biographical information about our directors is provided in “Election of Director — Proposal No. 1” on page 33.

Director Independence

We use the definition of “independence” of The Nasdaq Stock Market to make this determination. Nasdaq Listing Rule 5605(a)(2) provides that an “independent director” is a person other than an officer or employee of the Company or any other individual having a relationship which, in the opinion of the Company’s Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Nasdaq listing rules provide that a director cannot be considered independent if:

• the director is, or at any time during the past three years was, an employee of the Company;

• the director or a family member of the director accepted any compensation from the Company in excess of $120,000 during any period of 12 consecutive months within the three years preceding the independence determination (subject to certain exclusions, including, among other things, compensation for board or board committee service);

• a family member of the director is, or at any time during the past three years was, an executive officer of the Company;

• the director or a family member of the director is a partner in, controlling stockholder of, or an executive officer of an entity to which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exclusions);

• the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the Company served on the compensation committee of such other entity; or

• the director or a family member of the director is a current partner of the Company’s outside auditor, or at any time during the past three years was a partner or employee of the Company’s outside auditor, and who worked on the Company’s audit.

Our common stock is currently listed on the Nasdaq Global Select Market under the ticker symbol RLMD with a requirement that a majority of our Board of Directors be independent. Under the above-mentioned Nasdaq Global Select Market director independence rules, we believe that Charles J. Casamento, MBA, Eric Schmidt, John Glasspool and Paul Kelly, MBA qualify as independent directors of the Company.

Board Leadership Structure

Our Board of Directors has a policy that calls for the leadership role of the Board of Directors and Company management, namely the Chairman of the Board of Directors and the Chief Executive Officer, to be separate as it believes that the most effective leadership structure for us at this time is not to have these roles combined. Sergio

6

Traversa, PharmD, MBA serves as our Chief Executive Officer and Charles J. Casamento, R.Ph, MBA is our Chairman of the Board. We believe this structure of having a separate Chief Executive Officer and Chairman of the Board provides proper oversight of the Company and its operations.

Board Risk Oversight

Risk management is primarily the responsibility of the Company’s management; however, the Board of Directors has responsibility for overseeing management’s identification and management of those risks. The Board of Directors considers risks in making significant business decisions and as part of the Company’s overall business strategy. The Board of Directors and its committees, as appropriate, discuss and receive periodic updates from senior management regarding significant risks, if any, to the Company in connection with the annual review of the Company’s business plan and its review of budgets, strategy and major transactions.

Board of Directors Meetings and Attendance

During the fiscal year ended December 31, 2021, the Board of Directors held 5 meetings. All directors attended the board meetings.

Code of Ethics and Business Conduct

We adopted a Code of Ethics and Business Conduct that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. A copy of the Code of Ethics and Business Conduct is available on the Company’s website, under About Relmada using the tab Governance/Compliance at www.relmada.com. We will post on our website any amendment to our Code of Ethics and Business Conduct or waivers of our Code of Ethics and Business Conduct for directors and executive officers.

Communications with Directors

The Board of Directors has procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Charles J. Casamento, Chairman of the Board of Relmada Therapeutics, Inc., 2222 Ponce de Leon Blvd., Floor 3, Coral Gables, Florida 33134. Correspondence received that is addressed to the non-employee directors will be reviewed by our Chairman of the Board or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our Chairman of the Board, deals with the functions of the Board of Directors or committees thereof or that the Chairman of the Board otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by Relmada Therapeutics, Inc. that is addressed to the non-employee members of the Board of Directors and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (786) 629-1376.

Legal Proceedings

None of the Company’s current directors or executive officers have been involved, in the past ten years and in a manner material to an evaluation of such director’s or officer’s ability or integrity to serve as a director or executive officer, in any of those “Certain Legal Proceedings” more fully detailed in Item 401(f) of Regulation S-K, which include but are not limited to, bankruptcies, criminal convictions and an adjudication finding that an individual violated federal or state securities laws.

Because of the size of the Board of Directors and the historically small turnover of its members, the Board of Directors and independent directors (with respect to selecting and nominating independent directors) address the need to retain members and fill vacancies after discussion among current members. Accordingly, the Board of Directors and Corporate Governance and Nominating Committee have determined that it is appropriate not to have such a policy at this time.

7

Whistle Blowing Policy

We have adopted a Company Whistle Blowing Policy, for which a copy will be provided to any person requesting same without charge. To request a copy of our Whistle Blowing Policy please make written request to our Chief Executive Officer, at Relmada Therapeutics, Inc., 2222 Ponce de Leon Blvd., Floor 3, Coral Gables, Florida 33134. We believe our Whistle Blowing Policy is reasonably designed to provide an environment where our employees and consultants may raise concerns about any and all dishonest, fraudulent or unacceptable behavior, which, if disclosed, could reasonably be expected to raise concerns regarding the integrity, ethics or bona fides of the Company.

Compliance with Section 16(a) of the Exchange Act

Based solely upon a review of copies of such forms filed on Forms 3, 4 and 5, and amendments thereto furnished to us, we believe that as of the date of this Report, our executive officers, directors and greater than 10 percent beneficial owners have complied on a timely basis with all Section 16(a) filing requirements.

8

Our Board of Directors has formed three standing committees: audit, compensation, and nominating and corporate governance. Actions taken by our committees are reported to the full board. Each of our committees has a charter and each charter is posted on our website.

|

Audit Committee |

Corporate Governance and |

Compensation Committee |

||

|

Eric Schmidt* |

John Glasspool* |

Paul Kelly* |

||

|

Charles J. Casamento |

Charles J. Casamento |

Charles J. Casamento |

||

|

Paul Kelly |

Eric Schmidt |

John Glasspool |

____________

* Indicates committee chair

Audit Committee

Our Audit Committee, which currently consists of three directors, provides assistance to our Board of Directors in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, financial reporting, internal control and compliance functions of the Company. The committee met four times in 2021 and has a charter which is reviewed annually. Our Audit Committee employs an independent registered public accounting firm to audit the financial statements of the Company and perform other assigned duties. Further, our Audit Committee provides general oversight with respect to the accounting principles employed in financial reporting and the adequacy of our internal controls. In discharging its responsibilities, our audit committee may rely on the reports, findings and representations of the Company’s auditors, legal counsel, and responsible officers. Our Board of Directors has determined that all members of the Audit Committee are financially literate within the meaning of SEC rules and under the current listing standards of The Nasdaq Stock Market. Eric Schmidt is the chairman of the Audit Committee.

Corporate Governance and Nominating Committee

Our Board of Directors has a Corporate Governance and Nominating Committee composed of John Glasspool, Charles J. Casamento and Eric Schmidt. Mr. Glasspool serves as the chairman of the committee. The committee is charged with the responsibility of reviewing our corporate governance policies and with proposing potential director nominees to the board of directors for consideration. The committee met four times in 2021 and has a charter which is reviewed annually. All members of the Nominating and Corporate Governance Committee are independent directors as defined by the rules of the Nasdaq Stock Market. The Nominating and Corporate Governance Committee will assess all director nominees using the same criteria. During 2021, we did not pay any fees to any third parties to assist in the identification of nominees. During 2021, we did not receive any director nominee suggestions from stockholders.

Compensation Committee

Our Compensation Committee, which currently consists of three directors, establishes executive compensation policies consistent with the Company’s objectives and stockholder interests. The committee met once in 2021 and has a charter which is reviewed annually. Our Compensation Committee also reviews the performance of our executive officers and establishes, adjusts and awards compensation, including incentive-based compensation, as more fully discussed below. In addition, our compensation committee generally is responsible for:

• establishing and periodically reviewing our compensation philosophy and the adequacy of compensation plans and programs for our directors, executive officers and other employees;

• overseeing our compensation plans, including the establishment of performance goals under the Company’s incentive compensation arrangements and the review of performance against those goals in determining incentive award payouts;

• overseeing our executive employment contracts, special retirement benefits, severance, change in control arrangements and/or similar plans;

9

• acting as administrator of any Company stock option plans; and

• overseeing the outside consultant, if any, engaged by the Compensation Committee.

Our Compensation Committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The compensation committee also periodically reports to the board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the Compensation Committee deems it appropriate, recommends changes to our director compensation practices to our Board of Directors for approval.

Outside consulting firms retained by our Compensation Committee and management also will, if requested, provide assistance to the Compensation Committee in making its compensation-related decisions.

10

Non-management Directors of the Company receive a quarterly cash retainer of $15,000 per calendar quarter for their service on the Board of Directors. They also receive reimbursement for out-of-pocket expenses and certain directors have received stock option grants for shares of Company common stock as described below. Our Chairman of the Board receives additional compensation of $57,000 per year for his role as chairman.

Board committee members will receive the following annual compensation for committee participation:

|

BOD Committee |

Chairman |

Member |

||||

|

Audit |

$ |

20,000 |

$ |

9,000 |

||

|

Compensation |

$ |

14,500 |

$ |

7,000 |

||

|

Corporate Governance and Nominating |

$ |

14,500 |

$ |

7,000 |

||

The following table sets forth the compensation of our directors for the years ended December 31, 2021:

|

Name |

Fees |

Stock |

Option |

All Other |

Total |

||||||||||

|

Charles J. Casamento |

$ |

140,000 |

$ |

— |

$ |

4,918,550 |

$ |

— |

$ |

5,058,550 |

|||||

|

Paul Kelly |

$ |

83,500 |

$ |

— |

$ |

8,505,900 |

$ |

— |

$ |

8,589,400 |

|||||

|

Eric Schmidt |

$ |

87,000 |

$ |

— |

$ |

4,918,550 |

$ |

— |

$ |

5,005,550 |

|||||

|

John Glasspool |

$ |

81,500 |

$ |

— |

$ |

4,918,550 |

$ |

— |

$ |

5,000,050 |

|||||

The following table sets forth the compensation of our directors for the years ended December 31, 2020:

|

Name |

Fees |

Stock |

Option |

All Other |

Total |

||||||||||

|

Charles J. Casamento |

$ |

140,000 |

$ |

— |

$ |

— |

$ |

— |

$ |

140,000 |

|||||

|

Paul Kelly |

$ |

83,500 |

$ |

— |

$ |

— |

$ |

— |

$ |

83,500 |

|||||

|

Eric Schmidt |

$ |

87,000 |

$ |

— |

$ |

— |

$ |

— |

$ |

87,000 |

|||||

|

John Glasspool |

$ |

81,500 |

$ |

— |

$ |

— |

$ |

— |

$ |

81,500 |

|||||

____________

(a) This column shows the grant date fair value of awards computed in accordance with stock-based compensation accounting rules Accounting Standards Codification Topic 718.

11

The Audit Committee of the Board of Directors (the “Audit Committee”) was formed in July 2015. The Audit Committee is composed of the following three directors: Eric Schmidt, Charles Casamento and Paul Kelly, each of whom is “independent” as defined by the rules of The Nasdaq Stock Market. Mr. Schmidt serves as chairman of the Audit Committee.

Management is responsible for the Company’s financial statements, financial reporting process and systems of internal accounting and financial reporting control. The Company’s independent auditor is responsible for performing an independent audit of the Company’s financial statements in accordance with auditing standards generally accepted in the United States and for issuing a report thereon. The Audit Committee’s responsibility is to oversee all aspects of the financial reporting process on behalf of the Board of Directors. The responsibilities of the Audit Committee also include engaging and evaluating the performance of the accounting firm that serves as the Company’s independent auditor.

The Audit Committee discussed with the Company’s independent auditor, with and without management present, such auditor’s judgments as to the quality, not just acceptability, of the Company’s accounting principles, along with such additional matters required to be discussed under the Statement on Auditing Standards No. 61, “Communication with Audit Committees.” The Audit Committee has discussed with the independent auditor, the auditor’s independence from the Company and its management, including the written disclosures and the letter submitted to the Audit Committee by the independent auditor as required by the Independent Standards Board Standard No. 1, “Independence Discussions with Audit Committees.”

In reliance on such discussions with management and the independent auditor, review of the representations of management and review of the report of the independent to the Audit Committee, the Audit Committee recommended (and the Board approved) that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021. The Audit Committee and the Board of Directors have also, respectively, recommended and approved the selection of the Company’s current independent auditor, which approval is subject to ratification by the Company’s stockholders.

Submitted by:

Audit Committee of the Board of Directors

/s/ Eric Schmidt Chairman of the Audit Committee

/s/ Charles Casamento

/s/ Paul Kelly

____________

* The information contained in this Audit Committee Report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, or the Exchange Act, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Act, or the Exchange Act.

12

DIRECTORS AND EXECUTIVE OFFICERS

The following sets forth information about our directors and executive officers as of March 31, 2022:

|

Name |

Age |

Position |

||

|

Sergio Traversa |

61 |

Chief Executive Officer, and Director |

||

|

Maged Shenouda |

57 |

Chief Financial Officer |

||

|

Charles Ence |

62 |

Chief Accounting and Compliance Officer |

||

|

Charles J. Casamento |

75 |

Chairman of the Board and Director |

||

|

Paul Kelly |

63 |

Director |

||

|

Eric Schmidt |

52 |

Director |

||

|

John Glasspool |

59 |

Director |

Sergio Traversa has been our Chief Executive Officer and director since April 2012. Mr. Traversa was our Interim Chief Financial Officer from February 2017 to July 2019. Previously, from January 2010 to April 2012 he was the Chief Executive Officer of Medeor Inc., a spinoff pharmaceutical company from Cornell University. From January 2008 to January 2010, Mr. Traversa was a partner at Ardana Capital. Mr. Traversa has over thirty years of experience in the healthcare sector in the United States and Europe, ranging from management positions in the pharmaceutical industry to investing and strategic advisory roles. He has held financial analyst, portfolio management and strategic advisory positions at large U.S. investment firms specializing in healthcare, including Mehta & Isaly, ING Barings, Merlin BioMed and Rx Capital. In Europe, he held the position of Area Manager for Southern Europe of Therakos Inc., a cancer and immunology division of Johnson & Johnson. Prior to Therakos, Mr. Traversa was at Eli Lilly, where he served as Marketing Manager of the Hospital Business Unit. He was also a member of the CNS (Central Nervous System) team at Eli Lilly, where he participated in the launch of Prozac and the early development of Zyprexa and Cymbalta. Mr. Traversa started his career as a sales representative at Farmitalia Carlo Erba, now part of Pfizer. Mr. Traversa served as a board member of Actinium Pharmaceuticals, Inc. Mr. Traversa holds a Laurea degree in Pharmacy from the University of Turin (Italy) and an MBA in Finance and International Business from the New York University Leonard Stern School of Business. As our Chief Executive Officer, Mr. Traversa is our most senior executive and as such provides our Board of Directors with the greatest insight into our business and the challenges and material risks it faces. Mr. Traversa has approximately 30 years of healthcare industry experience and is especially qualified to understand the risks and leadership challenges facing a growing pharmaceutical company from a senior management and financial expertise perspective led us to conclude that Mr. Traversa should serve as Chief Executive Officer and Director of the Company.

Maged Shenouda has been our Chief Financial Officer since January 2020. He was also our director from November 2015 to January 2020. During his time as a director with the Company Mr. Shenouda was a member of the Audit Committee and Compensation Committee, and Chairman of the Corporate Governance and Nominating Committee. Mr. Shenouda has over 25 years of biotechnology and equity research experience. From September 2017 to November 2019, Mr. Shenouda was the Chief Financial Officer of AzurRx Biopharma, Inc. where he also served as a Director from October 2015 to October 2019. Prior to this Mr. Shenouda was the Head of Business Development and Licensing at Retrophin, Inc. from January 2014 to November 2014. Prior to that, he spent the bulk of his career as an equity analyst. He has held senior level positions at UBS, JP Morgan and Stifel Nicolaus, covering a broad range of small and large capitalization biotechnology companies. Mr. Shenouda started his sell-side equity research career at Citigroup and Bear Stearns where his coverage universe focused on U.S and European pharmaceutical companies. Before entering Wall Street, he was a management consultant with PricewaterhouseCoopers Pharmaceutical Consulting practice and also spent time in pharmaceutical sales, having worked as a hospital representative and managed care specialist for Abbott Laboratories Pharmaceutical Products Division. He earned a B.S. in Pharmacy from St. John’s University and is a registered pharmacist in New Jersey and California. He also received an M.B.A from Rutgers Graduate School of Management.

Charles Ence was appointed as our Chief Accounting and Compliance Officer in January 2020. Prior to this he was our Chief Financial Officer from July 29, 2019 to January 9, 2020. From October 2018 until June 2019, Mr. Ence was Corporate Controller of New Age Beverages Corp/Xing Beverages, LLC (“New Age”) located in Denver, Colorado. From August 2003 until October 2018, Mr. Ence was Chief Financial Officer of New Age. He managed all the financial affairs of New Age and their other portfolio companies helping lead the firm into becoming one of the top 100 non-alcoholic beverage companies worldwide. He helped guide the expansion of the business to ultimately penetration of 46 states domestically and 10 countries internationally, with consistent growth and profitability throughout his tenure. Prior to New Age, Mr. Ence was a senior executive, Planning Manager and Director of Finance for Quantum Corp. Following Quantum he served as a Director of Finance and Investor Relations at On Command Corp. Mr. Ence began his career at PepsiCo. During his 12 years at PepsiCo, Mr. Ence served as a financial analyst, planning supervisor, planning and analysis manager and ultimately controller.

13

He received his Bachelor of Arts in Business Administration and Accounting from Southern Utah University in 1984, and obtained a Master’s in Business Administration in Finance from Arizona State University School of Business in 1985.

Board of Directors

Charles J. Casamento has been our Chairman of the Board since June 2017 and a director since July 2015. Mr. Casamento is a member of our Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee. Since 2007 Mr. Casamento is Executive Director and Principal of The Sage Group, a health care advisory group specializing in business development strategies and transactions. Prior to The Sage Group he was President and CEO of Osteologix from October 2004 until April 2007.

Earlier in his career, Mr. Casamento was Senior Vice President & General Manager for Pharmaceuticals and Biochemicals at Genzyme. In 1993, Mr. Casamento joined RiboGene as Chairman, President and CEO. He took the Company public and completed several major corporate collaborations and R&D collaboration agreements as well as a merger with a public corporation in 1998 to form Questcor Pharmaceuticals, where he was Chairman, CEO and President until August 2004.

Prior to joining Genzyme in 1985 Mr. Casamento has held a number of marketing, sales, finance and business development positions with Novartis, Hoffmann-LaRoche, Johnson & Johnson and American Hospital Supply Corporation where he was Vice President of Business Development and Strategic Planning for the Critical Care Division from January 1983 until May 1985.

Mr. Casamento currently serves as an Independent Director for AzurRx Biopharma. During his career he has served on the boards of twelve public companies and two private companies. A graduate of Fordham University in New York City and Iona College in New Rochelle, New York. Mr. Casamento has a degree in Pharmacy and an MBA. Mr. Casamento brings over 35 years of biotechnology experience to our Board of Directors, having served in various senior positions over the course of his career, and that he has developed significant management and leadership skills relating to the pharmaceutical industry, led us to conclude that Mr. Casamento should serve as a director.

Paul Kelly has been a director of the Company since November 2015. Mr. Kelly is also Chairman of the Compensation Committee, and a member of the Audit Committee and Corporate Governance and Nominating Committee. Mr. Kelly has been actively involved as an analyst, consultant and investor in the biotechnology sector for the past twenty years. He began as an equity analyst at Mabon Securities in 1993, and served in the same capacity at UBS Securities, Volpe, Brown, Whalen, ING Securities and Merrill Lynch. Mr. Kelly was named to the inaugural Fortune magazine All Star Analyst team in 2000. Subsequently, since 2007 Mr. Kelly has engaged in consulting for both private and public biotechnology companies and for hedge funds. He currently manages his own investments and continues his industry consulting activities. Mr. Kelly has advised Spring Bank Pharmaceuticals, Inc. and VisionGate, Inc. Mr. Kelly holds an A.B. in Biochemistry from Brown University, from which he was graduated magna cum laude, Sigma Xi and Phi Beta Kappa. He attended the University of Rochester School of Medicine and received an M.B.A. in Finance from the William E. Simon School at the University of Rochester. That Mr. Kelly brings over 25 years of biotechnology experience to our Board of Directors, having served in various executive-level positions over the course of his career, and that he has developed significant management and leadership skills relating to the pharmaceutical industry, led us to conclude that Mr. Kelly should serve as a director.

Eric Schmidt has been a Director of the Company since December 19, 2019. Dr. Schmidt is also the Chairman of the Company’s Audit Committee and a member of the Company’s Corporate Governance and Nominating Committee. He has served as the Chief Financial Officer of Allogene Therapeutics, Inc. since June 2018. Prior to joining Allogene Therapeutics, Dr. Schmidt was a Managing Director and Senior Research Analyst at Cowen and Company, LLC. He joined Cowen as a Research Analyst in 1998 where he covered biotechnology stocks until June 2018. He was previously a Vice President and Research Analyst for UBS Securities. Before joining UBS in 1995, he co-founded Cambridge Biological Consultants, a scientific consulting and research firm. Dr. Schmidt obtained a Bachelor of Arts in Chemistry from the University of Pennsylvania and a Ph.D. in Biology from the Massachusetts Institute of Technology. That Dr. Schmidt brings over 25 years of biotechnology and financial experience to our Board of Directors, having served in various executive-level positions over the course of his career, and that he has developed significant management and leadership skills relating to the pharmaceutical industry led us to conclude that Dr. Schmidt should serve as a director.

14

John Glasspool has been a Director of the Company since December 19, 2019. Mr. Glasspool is also a member of the Company’s Compensation Committee and Chairman of the Company’s Corporate Governance and Nominating Committee. He has been CEO and member of the Board of Directors of Anthos Therapeutics since February 2019. He is also has been a member of the Board of Directors of Dalcor Corporation since May 2017, and a senior advisor to MIT since October 2016. From June 2017 to October 2018, he was a consultant for Roivant Sciences. From July 2015 to January 2017, Mr. Glasspool was the Executive Vice President, Head of Corporate Strategy and Customer Operations at Baxalta Incorporated, formerly Baxter BioScience. From August 2012 to June 2015, he was Vice President, Emerging Therapies and Market Development at Baxter Bioscience. Mr. Glasspool obtained a Bachelor of Arts degree from the University of Staffordshire and a degree in Business Administration from Oxford University. That Mr. Glasspool brings over 25 years of biotechnology experience to our Board of Directors, having served in various executive-level positions over the course of his career, and that Mr. Glasspool has developed significant management and leadership skills relating to the pharmaceutical industry led us to conclude that Mr. Glasspool should serve as a director.

15

Compensation Discussion and Analysis

The following discussion provides compensation information under SEC rules and may contain statements regarding future individual and Company performance targets and goals. These targets and goals are disclosed in the limited context of the Company’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution stockholders not to apply these statements to other contexts.

Executive Summary

Our Compensation Committee is responsible for overseeing our compensation programs, plans and policies; administering our equity incentive plans; reviewing and approving annually all compensation decisions relating to our executive officers other than our Chief Executive Officer; and making recommendations to the full Board of Directors regarding compensation for our Chief Executive Officer and for the Board of Directors. The Compensation Committee considers recommendations from our Chief Executive Officer regarding the compensation of our executive officers other than himself. Our Compensation Committee has the authority under its charter to engage the services of a consulting firm or other outside advisor to assist it in designing our compensation programs and in making compensation decisions.

This Compensation Discussion and Analysis discusses the principles underlying our policies and decisions with respect to the compensation of our named executive officers (NEOs), and all material factors relevant to an analysis of these policies and decisions. Our NEOs for the fiscal year ended on December 31, 2021 are:

— Sergio Traversa, PharmD, MBA, our Chief Executive Officer;

— Maged Shenouda, our Chief Financial Officer; and

— Charles Ence, our Chief Accounting and Compliance Officer.

Corporate Highlights for 2021 and Priorities and Milestones for 2022

Fiscal 2021 was a year of building and significant operational and regulatory accomplishments for our Company. As discussed in more detail below, our executive compensation program is designed to align the interests of our stockholders, officers and employees by tying compensation to individual and Company performance, including the achievement of certain business goals or milestones. The following summarizes key highlights and accomplishments for fiscal 2021 and 1st quarter of 2022:

• Started RELIANCE II, the second of two sister pivotal Phase 3 clinical trials (RELIANCE I and RELIANCEII) of REL-1017, as an adjunctive treatment for MDD.

• Started RELIANCE III, the ongoing monotheraphy trial for REL-1017.

• Announced top-line results that showed REL-1017 showed a highly statistically significant difference in abuse potential versus oxycodone with a p-values less than .001, and were statistically equivalent to placebo.

• During first quarter of 2022, we announced top-line results that showed that REL-1017 demonstrated a substantial (30+ points) and statistically significant difference vs. the active control drug, intravenous ketamine 0.5 mg/kg over 40 minutes, and were statistically equivalent to placebo.

In addition, the Company has outlined the following expected key strategic priorities and milestones for 2022:

• Results of RELIANCE III monotherapy MDD trial in mid-2022.

• Results of RELIANCE I and RELIANCE II adjunctive MDD trials in the third and fourth quarter 2022, respectively.

• Results of RELIANCE — OLS (Long-term, Open-label) study in MDD in the fourth quarter of 2022.

16

Stockholder Engagement

In evaluating our executive compensation program, the Compensation Committee considers a number of factors, as discussed in this Compensation Discussion and Analysis section, including any feedback we receive from our stockholders about our executive compensation program.

In 2021, our stockholders voted on an advisory basis with respect to our compensation program for named executive officers. Of the votes cast (excluding abstentions and broker non-votes), 93.4% were cast in support of the program. While this vote was a non-binding advisory vote, our Compensation Committee believes that the stockholders, through this advisory vote, generally endorsed our compensation philosophy and principles. As a result, our Compensation Committee decided to maintain our general approach to executive compensation and made no significant changes to our executive compensation program since our 2021 annual meeting.

Objectives of Our Compensation Program

Our compensation program for executive officers is designed to align the interests of our stockholders, officers and employees by tying compensation to individual and Company performance, both directly in the form of salary or annual cash incentive payments, and indirectly in the form of equity awards. The objectives of our compensation program enhance our ability to:

• align pay with performance with the interests of stockholders by linking a portion of total compensation to the achievement of Company-wide performance criteria;

• attract and retain qualified and talented individuals; and

• provide reasonable and appropriate incentives and rewards to our team for building long-term value within our Company, in each case in a manner comparable and competitive with the compensation policies of companies similar to ours.

In addition, we strive to be competitive with other similarly situated companies in our industry. The process of developing pharmaceutical products and bringing those products to market is a long-term proposition and outcomes may not be measurable for several years. Therefore, in order to build long-term value for our Company and its stockholders, and in order to achieve our business objectives, we believe that we must compensate our officers and employees in a competitive and fair manner that reflects current Company activities but also reflects contributions to building long-term value.

The Company maintains an ongoing commitment to good corporate governance principles and strong performance orientation in our compensation program by proactively reviewing our policies and program design.

Compensation Philosophy

Our Compensation Committee believes that a well-designed compensation program should align executive interests with the drivers of growth and stockholder returns, including by supporting the Company’s achievement of its primary business goals and the Company’s ability to attract and retain employees whose talents, expertise, leadership, and contributions are expected to build and sustain growth in long-term stockholder value. As a result, we maintain a strong pay-for-performance orientation in our compensation program.

To achieve these objectives, our Compensation Committee reviews our compensation policies and program design overall to ensure that they are aligned with the interests of our stockholders and our business goals, and that the total compensation paid to our employees and directors is fair, reasonable and competitive for our size and stage of development. Specifically, our Compensation Committee targets base salaries, annual cash bonuses, and annual long-term equity incentive awards for our executive officers around the market median for our peer group, with variability in actual payments based on corporate and individual performance.

17

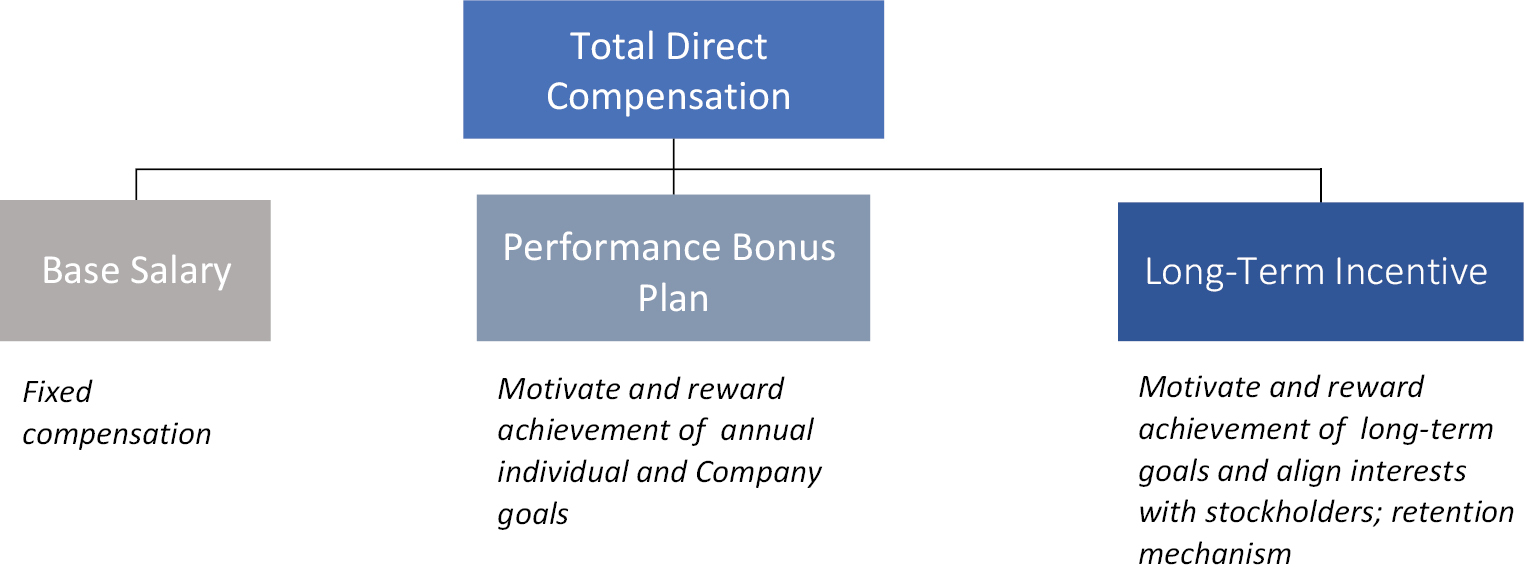

Executive Compensation Elements

Key elements of our compensation programs include the following:

Base Salary

Base salary is used to recognize the experience, skills, knowledge and responsibilities required of our (NEOs) as well to provide a secure base of cash compensation and recognize the competitive nature of the biopharmaceutical industry. This is determined partially by evaluating our peer companies as well as the degree of responsibility and experience levels of our NEOs and their overall contributions to our Company. Base salary is one component of the compensation package for NEOs; the other components being cash bonuses, annual equity grants and Company benefit programs. Base salary is determined in advance whereas the other components of compensation are awarded in varying degrees following an assessment of the performance of a NEO. This approach to compensation reflects the philosophy of our Board of Directors and its Compensation Committee to emphasize and reward, on an annual basis, performance levels achieved by our NEOs.

Performance Bonus Plan

We have a performance bonus plan under which bonuses are paid to our NEOs based on achievement of Company performance goals and objectives established by the Compensation Committee and/or our Board of Directors, as well as on individual performance. The bonus program is discretionary and is intended to: (i) strengthen the connection between individual compensation and our Company’s achievements; (ii) encourage teamwork among all disciplines within our Company; (iii) reinforce our pay-for-performance philosophy by awarding higher bonuses to higher performing employees; and (iv) help ensure that our cash compensation is competitive. Depending on the cash position of the Company, the Compensation Committee and our Board of Directors have the discretion to not pay cash bonuses in order that we may conserve cash and support ongoing development programs and commercialization efforts. Regardless of our cash position, we consistently grant annual merit-based stock options to continue incentivizing both our senior management and our employees.

Based on their employment agreements, each NEO is assigned a target payout under the performance bonus plan, expressed as a percentage of base salary for the year. Actual payouts under the performance bonus plan are based on the achievement of corporate performance goals and an assessment of individual performance, each of which is separately weighted as a component of such officer’s target payout. For the NEOs, the corporate goals receive the highest weighting in order to ensure that the bonus system for our management team is closely tied to our corporate performance. Each employee also has specific individual goals and objectives as well that are tied to the overall corporate goals. For employees, mid-year and end-of-year progress should be reviewed with the employees’ managers.

Long-Term Equity Incentive Compensation

We view long-term compensation, currently in the form of stock options and restricted stock generally vesting in annual increments over four years and/or vesting as certain milestones are achieved, as a tool to align the interests of our NEOs and employees generally with the creation of stockholder value, to motivate our employees to achieve and exceed corporate and individual objectives and to encourage them to remain employed by the Company. While cash compensation is a significant component of employees’ overall compensation, the Compensation Committee and our Board of Directors (as well as our NEOs) believe that the driving force of any employee working in a small biotechnology company should be strong equity participation. We believe that this now only creates the potential for substantial longer term corporate value but also serves to motivate employees and retain their loyalty and commitment with appropriate personal compensation.

18

Other Compensation

In addition to the main components of compensation outlined above, we also provide contractual severance and/or change in control benefits to our NEOs. The change in control benefits for all applicable persons have a “double trigger.” A double-trigger means that the executive officers will receive the change in control benefits described in the agreements only if there is both (1) a Change in Control of our Company (as defined in the agreements) and (2) a termination by us of the applicable person’s employment “without cause” or a resignation by the applicable persons for “good reason” (as defined in the agreements) within a specified time period prior to or following the Change in Control. We believe this double trigger requirement creates the potential to maximize stockholder value because it prevents an unintended windfall to management as no benefits are triggered solely in the event of a Change in Control while providing appropriate incentives to act in furtherance of a change in control that may be in the best interests of the stockholders. We believe these severance or change in control benefits are important elements of our compensation program that assist us in retaining talented individuals at the executive and senior managerial levels and that these arrangements help to promote stability and continuity of our executives and senior management team. Further, we believe that the interests of our stockholders will be best served if the interests of these members of our management are aligned with theirs. We believe that providing change in control benefits lessens or eliminates any potential reluctance of members of our management to pursue potential change in control transactions that may be in the best interests of the stockholders. We also believe that it is important to provide severance benefits to members of our management, to promote stability and focus on the job at hand.

We also provide benefits to the executive officers that are generally available to all regular full-time employees of our Company, including our medical and dental insurance, and a 401(k) plan. At this time, we do not provide any perquisites to any of our NEOs. Further, we do not have deferred compensation plans, pension arrangements or post-retirement health coverage for our executive officers or employees. All of our employees not specifically under contract are “at-will” employees, which means that their employment can be terminated at any time for any reason by either us or the employee. Our CEO, CFO and CAO each has an employment agreement that provides lump sum compensation in the event of the termination without cause or, under certain circumstances, upon a Change in Control.

Determination of Compensation Amounts

A number of factors impact the determination of compensation amounts for our NEOs, including the level of responsibility of the individual officer and the officer’s performance, length of service with the Company, competition for talent, individual compensation package, and assessments of internal pay equity and industry data. Stock price performance has generally not been a factor in determining annual compensation because the price of our common stock is subject to a variety of factors outside of our control.

Defining and Comparing Compensation to Market Benchmarks

We engage external compensation consultants to establish and maintain a list of peer companies to best assure ourselves that we are compensating our executives on a fair and reasonable basis. We also utilize compensation consultants to provide data for below-executive level personnel, which data focuses on similarly-sized bio-tech companies. The availability of peer data is used by the Compensation Committee strictly as a guide in determining compensation levels with regard to salaries, cash bonuses and performance related annual equity grants to all employees. However, the availability of these data does not imply that the Compensation Committee is under any obligation to exactly follow peer companies in compensation matters.

In evaluating the total compensation of our named executive officers, our Compensation Committee reviews publicly available compensation data and survey data provided by our compensation consultant from a peer group of publicly traded, national and regional companies in the biopharmaceutical and biotechnology industries. Our Compensation Committee establishes our peer group, based on the recommendation of our compensation consultant, using a balance of the following criteria:

• companies whose number of employees, stage of development and market capitalization are similar, though not necessarily identical, to ours;

• companies with similar executive positions to ours;

• companies against which we believe we compete for executive talent; and

19

• public companies based in the United States whose compensation and financial data are available in proxy statements or through widely available compensation surveys.

In determining the 2022 base salaries, cash bonus opportunities and equity grants for our named executive officers, our Compensation Committee relied on the following peer group, prepared by external and independent compensation consultants and approved by the Compensation Committee in December 2021, which we call our 2022 Peer Group:

• Alector Inc.

• Axsome Therapeutics Inc.

• Brainstorm Cell Therapeutics

• Cara Therapeutics Inc.

• Cytokinetics Inc.

• Homology Medicines Inc.

• Marinus Pharmaceuticals Inc.

• Ovid Therapeutics Inc.

• Revance Therapeutics Inc.

• Sage Therapeutics

• Voyager Therapeutics Inc.

• Wave Life Sciences Ltd

Compensation Objectives

Our compensation programs are designed to attract, motivate and retain qualified and talented executives, motivating them to achieve our business goals and rewarding them for superior short- and long-term performance. In particular, our compensation programs are intended to reward the achievement of corporate performance against specified pre-determined quantitative and qualitative goals and objectives and individual performance in helping to achieve those goals and objectives and advance the business and to align the interests of our leadership team with those of our stockholders.

Determination of Base Salaries

As a guideline for NEO base salary, we perform formal benchmarks against respective comparable positions in our established peer group. We adjust salaries based on our assessment of our NEOs’ levels of responsibility, experience, overall compensation structure and individual performance. The Compensation Committee is not obliged to raise salaries purely on the availability of data. Merit-based increases to salaries of executive officers are based on our assessment of individual performance and the relationship to applicable salary ranges. Cost of living adjustments may also be a part of that assessment.

Performance Bonus Plan

Concurrently with the beginning of each calendar year, preliminary corporate goals that reflect our business priorities for the coming year are prepared by the CEO with input from the other executive officers. These goals are weighted by relative importance. The draft goals and proposed weightings are presented to the Compensation Committee and the Board and discussed, revised as necessary, and then approved by our board of directors.

The Compensation Committee then reviews the final goals and their weightings to determine and confirm their appropriateness for use as performance measurements for purposes of the bonus program. The goals and/or weightings may be re-visited during the year and potentially restated in the event of significant changes in corporate strategy or the occurrence of significant corporate events. Following the agreement of our Board of Directors on the corporate

20

objectives, the goals are then shared with all employees in a formal meeting(s), and are reviewed periodically throughout the year.

Equity Grant Practices

All stock options and/or restricted stock granted to the NEOs and other executives are approved by the Board of Directors and the Compensation Committee. Exercise prices for options are set at the closing price of our common stock on the date of grant. Grants are generally made: (i) on the employee’s start date and (ii) at Board of Director meetings held each February and following annual performance reviews. However, grants have been made at other times during the year. The size of year-end grants for each NEO is assessed against our internal equity guidelines. Current market conditions for grants for comparable positions and internal equity may also be assessed. Also, grants may be made in connection with promotions or job related changes in responsibilities. In addition, on occasion, the Compensation Committee may make additional special awards for extraordinary individual or Company performance.

Compensation Setting Process